Supply Chain Risk Management for Now and the Future to secure your Business

Written by EO Executives on May 12, 2020

“The winners in the supply chain crisis are those companies, who can deliver when supply chain disasters happen and have a plan B ready to satisfy the customer”

Many companies are realising in these times of crisis that their overall long-term supply chain risk management is not satisfactory. Some companies cannot deliver to their customers, are enduring major business risks and many are fighting to survive.

Most companies develop plans to protect against recurrent, low-impact risks in their supply chains from supplier through to the customer. But many however, all but ignore high-impact, low-probability risks such as natural disasters, pandemics and system breakdowns.

Have you set up a business risk management process as part of your strategic review process which has evaluated high business global risk areas? Did you relate costs for risk mitigation and decide which strategic counter measures you actually want to implement?

Organizations have to build up financial models that estimate the impact of various risk scenarios and decide how much “insurance” to get to mitigate the specific gaps, such as by establishing dual supply sources or relocating production.

The analytical skills of risk analysis are well known in the financial sector—now is the time to apply them to supply chains.

In my past 20 years I have directly or indirectly been involved in 4 serious geographical supply chain crises, where certain regions of the world and global supply chains were affected due to disasters such as tsunami, earthquakes, pandemics and floods. Certainly, for many the 5th supply chain crisis is the Corona pandemic, which is the most serious worldwide disaster affecting customers and which is stressing many companies cash flows, supply chains and in some cases their very survival.

Examples of other supply chain crises are:

In 2003 the SARS outbreak:

Particularly focussed in China with many travel restrictions to limit the movement of people and goods. At that time, I was living in China and involved in setting up a new plant for SIG Combibloc in Suzhou, China.

In 2004 the Indian Ocean earthquake and tsunami:

According to the U.S. Geological Survey a total of 227,898 people died. Measured in lives lost, this is one of the ten worst earthquakes in recorded history, as well as the single worst tsunami in history.

In 2011 the Japan Nuclear outbreak:

In March 2011 the flooding from the tsunami caused the failure of cooling systems at the Fukushima Nuclear Power Plant. This disaster had major impacts for certain industrial and automotive companies since manufacturing clusters were located in the affected areas. At that time, I was involved in a daily taskforce as Head of Schaeffler Asia Procurement to review risks and solutions including back up plans.

In 2011 Thailand floods:

Severe flooding occurred during the November 2011 monsoon season in Thailand and 13.6 million people were affected. Disruption to manufacturing supply chains influenced regional automobile production and a global shortage of hard disk drives.

But what will be the next supply chain challenges in the world for your business after the Corona-Virus outbreak and how well will you be prepared next time? These four dramatically different crises listed above as well as the Corona virus outbreak, demonstrate the importance of pro-actively managing supply-chain risk and taking strategic decisions.

Supply-chain problems are not seldom and can result from: Natural disasters, pandemics, power supply shortages, system breakdowns (like IT systems), labour disputes, supplier bankruptcy, acts of war and terrorism, geopolitical risk factors like trade wars and other causes in any part of the world (not only Asia!). They can seriously disrupt or delay material, information and cash flows, any of which can damage sales, increase costs — or both.

Broadly categorized, potential supply-chain risks include: delays, disruptions, forecast inaccuracies, systems breakdowns, intellectual property breaches, procurement failures, inventory problems and capacity issues. Unforeseen risks exist and can happen, so it is vital that companies, as part of the strategic planning process, improve risk management evaluation and development of counter measures.

2. Do you only have plans for normal recurrent risks?

Managing supply-chain risk is difficult because individual risks are often interconnected. As a result, actions that solve one risk can end up exacerbating another. Consider a lean supply chain. While low inventory levels keep cost and cashflow low, they simultaneously increase the impact of a supply chain disruption. Similarly, actions taken by any company in the supply-chain can increase risk for any other participating company.

Most companies develop plans to protect against recurrent, low-impact risks in their supply chains from supplier through to customer. But many ignore high-impact, low-likelihood risks. For instance, a supplier with some short-term capacity or quality problems represents a common, recurrent disruption. Without much effort such problems normally can be solved. By contrast in regions where earthquakes are rare, preparedness to prevent major disruption may be weak or uneven.

So long-term companies must review all possible risks areas including high impact – low-likelihood risks. This means updating present strategies for the future and what measures to take into a Plan B to mitigate supply chain and business risks. Above all, it means to evaluate which risk mitigation can be implemented at what cost.

By understanding the variety and interconnectedness of supply-chain & supplier risks, managers can build tailor-balanced, effective risk-reduction strategies for their company. Risk management process as part of your strategic processes is necessary.

Long-term strategic reviews need to include overall risk management and related cost mitigation. It is not only how can we best serve the customer with cost competitive products & services and beat the competition. If you are not well prepared, it can be a question of survival, destruction of major shareholder values or losses of major business areas.

2. Do you have a risk management process in your group set up as a part of your strategic process?

Annually around the globe there should be, by entity and by function, a process with clear responsibilities of a ll

- major possible global risks including supply chain risks

- their consequences on turnover and profits

- their likelihood

- already existing countermeasures

- evaluation of possible risk mitigation measures and their costs

SCOPE:

Each legal entity and group should have this as a strategic process which at a minimum is updated annually and reviewed as a part of the strategic direction and risk management process.

RESPONSIBILITY:

Do you have a risk function set up to maintain and perform annual risk assessments? The responsibility for overall risk management “Cost – Benefit Analysis” should be located in the CFO area.

ESCALATIONS:

For the larger entity risk areas, corporate headquarters have to review plans and decide whether to accept them and/or to implement updated strategies or countermeasures.

STRESS TESTING:

tress testing is a group exercise that helps managers and their companies understand and prioritize supply-chain risks. “What if ” scenarios help key players to focus on each supply chain topic at a time. This strategy offers an especially effective way to gain organizational buy-in and shared ownership within project teams for tackling supply-chain risk.

3. Supply Chain Risk Management

Leading companies deal with a range of supply-chain risks by having certain safety stocks / back up options. Just as insurance companies hold cash reserves to meet claims, top manufacturers hold supply-chain reserves that include excess inventory, excess capacity and back up suppliers.

The big challenge for managers here: Mitigate risk by intelligently positioning and allocating supply-chain reserves without decreasing profits. Thus, while stockpiling inventory may shield a company against delivery delays by suppliers, building reserves in an undisciplined fashion also drives up costs and hurts the bottom line. The managers’ role here is similar to that of a stock portfolio manager:

Attain the highest achievable profits (reward) for varying levels of supply-chain risk and to do so efficiently.

Critical questions to evaluate in the risk assessment of possible disruptions in the supply chain are:

- How likely is it the risk of disruption can happen?

- What are the consequences of supply chain disruptions for the company and customers?

- How much extra costs / cash am I willing to pay for a protection here?

4. Strategies to optimize risks and cost for mitigations:

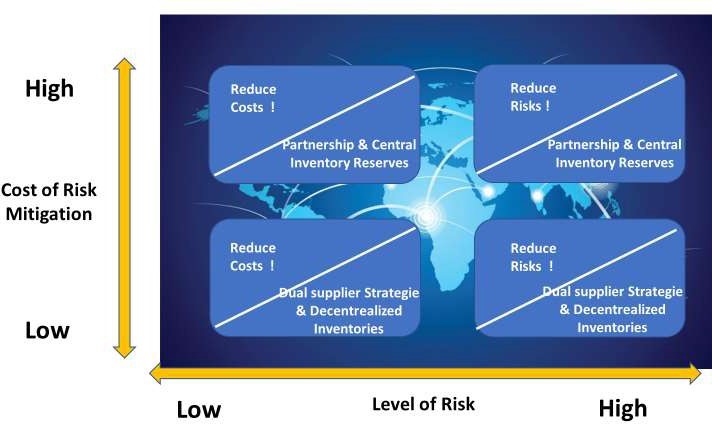

How a company plans for such threats depends on the type of disruption they are trying to mitigate against, given their organization’s current level of preparedness and secondly, how much risk the company want to take on and at what costs.

With a clear understanding of the types of supply-chain risks, managers in a variety of industries should tailor effective risk-reduction approaches in their own companies.

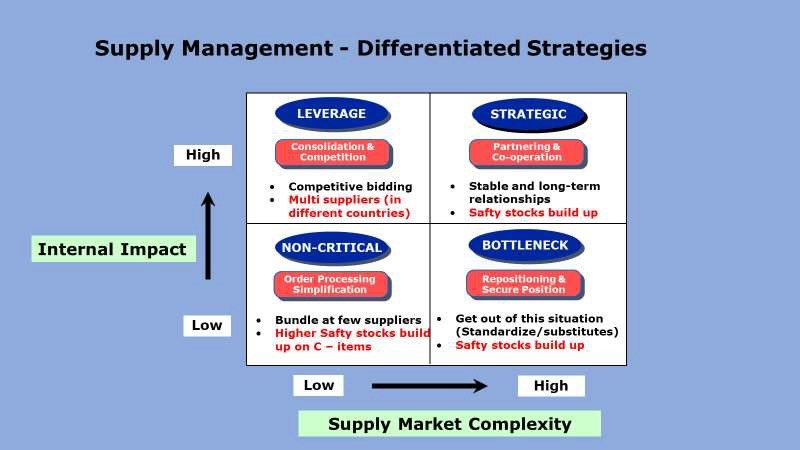

Fig 1: Classification of level of supply chain risk and related cost.

Typical strategic questions in a global world are:

Short term:

- Where shall we put extra supply chain inventory in order to build up and secure the short- term supply chain risks?

- How much extra inventory is needed, at what cost and where should it be located, at which value added stage (raw material, semi-finished goods, finished goods)?

- Where do we need additional capacityß

- Which of these costs can I pass on to suppliers or customers?

Long-term:

- Where shall we produce and source local and/or global?

- Where shall we have competitive local and/or global suppliers?

- Can I afford to have suppliers in different cost competitive countries and avoid single sourcing from one country?

- Where shall we have back up suppliers even if it maybe more expensive?

- What business risks do I have at market / customers side or shall I have a more balanced global customer / business / product portfolio to compensate for the ups and downs?

The answer to the above depends on business strategies, financial resources, risks and related costs - they are at the heart of a very strategic decision that every company has to take.

For most, overall supply chain risk is emphasised by the importance of not having all your eggs in one basket and indeed this might give the biggest short-term profits.

But on the other hand, this does not imply relocating all procurement spend to countries which are apparently disaster-free and therefore paying 20-30% higher costs, which in turn have to be passed on to customers.

Every company need a balanced approach in considering risk mitigation and costs & benefits.

5. Differentiated Supplier Strategies

You are most likely fully familiar with differentiated supplier strategies and here categorizing your high and low volume spend components / services into complex and simple commodities / services. See fig 2

Here also risk assessment and stress testing is required. If it is possible, you should always have a multiple supplier strategy – to mitigate risks by having suppliers in different regions / countries to offset regional natural disasters, pandemics, system breakdowns and so forth.

Example:

A company decided to source high-volume A list items from two suppliers not only located in cost competitive countries like China, but also to build up a local supplier in Europe to take 30% of the procurement spend. Certainly, this would cost the lost savings, but it would lower overall supply chain risk and can be seen as a type of ‘insurance’ or plan b.

A golden rule for your investments and business: ‘Don’t put all your eggs in one basket.’

Your highest risks will be those for areas where you have single supplier strategies. Sometimes these cannot be avoided since cost reasons do not allow for having two suppliers due to low volumes, or possibly due to high part complexity, where only one supplier can carry the high tooling cost or simply that the customer does not want to approve two suppliers.

For such situations, your only option is to accept a single-supplier strategy but do also secure the following:

-

Build up a certain level of safety stocks for risk periods.

-

Secure a reliable supply chain from supplier to customer and regularly review risk areas.

-

Overall strengthen your supply chain processes and tools from forecasting, capacity planning, to freight forwarding and overall inventory management.

-

Build strong supplier relationship management.

Over time, only strong supplier and customer collaboration can mutually reinforce their entire supplier and customer ecosystem and secure greater resilience.

Your tasks after overcoming the present Corona pandemic are to set-up the strategies for building resilience in supply chains for the future and to be better prepared next time.

Here you need to set up clear responsibility for supply chain risks, processes and tools and make transparent all risk-impact estimates and associated costs of risk mitigation. Last but not least, a clear governance structure must exist to ensure that high risk supply chain and business areas are evaluated at top group level.

Companies have to evaluate risk scenarios and decide how much “insurance” to buy, such as by establishing dual supply sources or relocating production or building up additional inventories for high risk components.

Several industrial and automotive companies I have seen have already rolled out global risk assessments - now is the time for you also to systematically implement them and be better prepared for the next serious supply chain risk situation. We all know it will come.

Nis-Peter Iwersen

Consulting / Procurement / Interim Manager / China / Asia Expert